2025 Constitutional Amendments

During the 89th Texas Legislative Session, 2/3 of both the Texas House and Senate approved 17 amendments to the constitution. The 17 amendments will be on the ballot this November and only require a simple majority to go into effect. Ballott Language and order can be found on the Texas Secretary of State website.

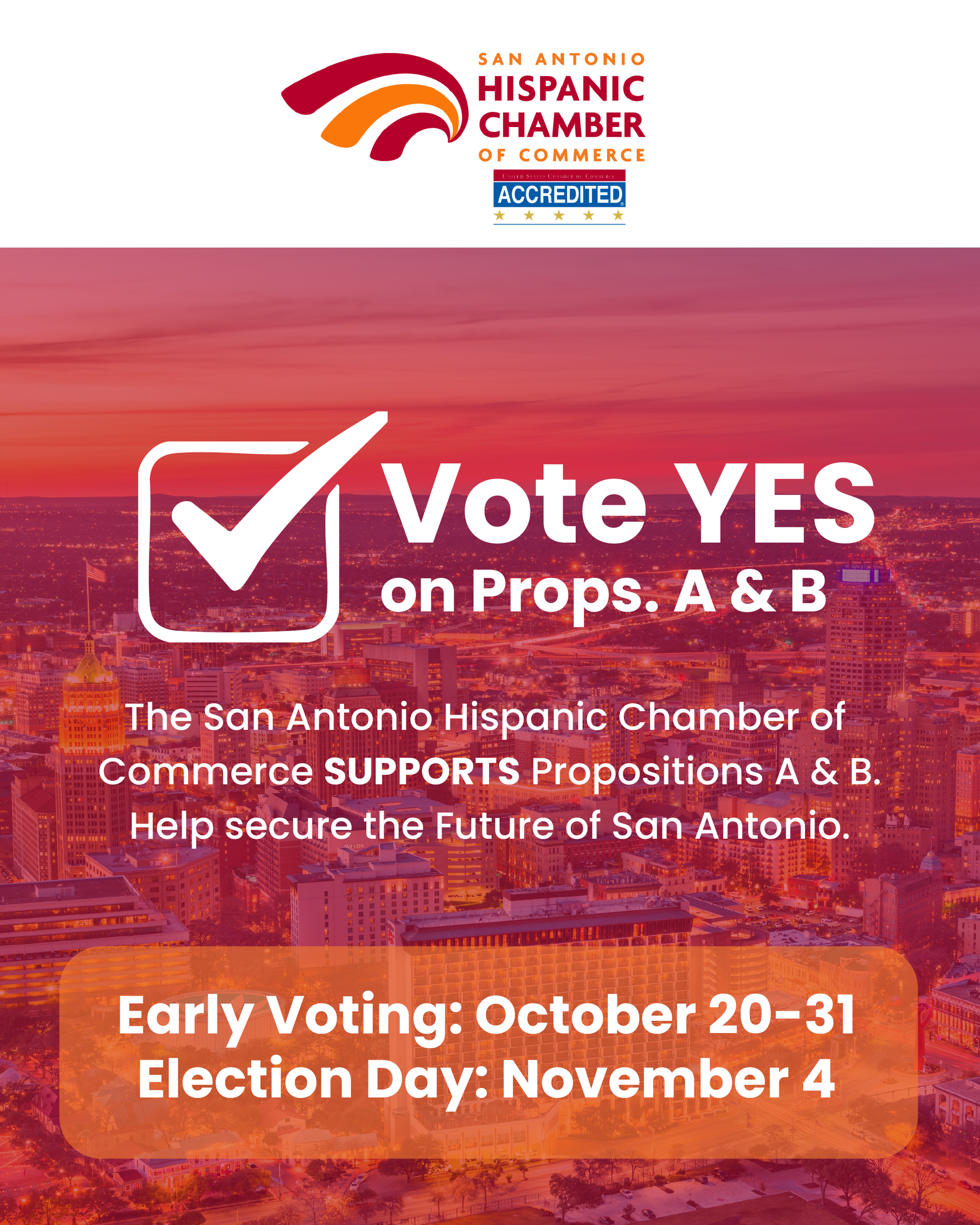

Election Day is November 4, 2025, and Early Voting will take place October 20-31st.

You can find information about the amendments and voting in Texas at VoteTexas.gov.

Your Voice, Your Business: Why This Election Matters

As the next voting day approaches, the future of Texas’ economic landscape will be shaped by what’s on the ballot, not just who’s on it. Legislative amendments and local propositions have real consequences for how our small businesses operate, grow, and thrive.

From taxes and infrastructure to innovation and workforce development, each proposition presents a choice that directly impacts our business community. The San Antonio Hispanic Chamber of Commerce (SAHCC) proudly supports legislative measures that strengthen our economy, reduce regulatory burdens, and invest in the foundations of long-term business success.

What’s at Stake

Each amendment on the ballot reflects an opportunity to protect and empower the business community. The priorities below mark SAHCC’s official Legislative Support for Election Day.

These priorities, endorsed by partners such as the Texas Association of Business and Texas 2036, reflect our shared commitment to policies that keep Texas open for business.

Download the amendments here, print them and take them with you to vote.

Local Impact: Proposition A & B

This November, Bexar County Propositions A and B present a once-in-a-generation opportunity to secure the future of San Antonio’s tourism, sports, and hospitality economy, and keep the San Antonio Spurs rooted in the city that built them. NO NEW TAXES. Beyond statewide measures, Propositions A and B on the Bexar County ballot will shape San Antonio’s future.

Proposition A

Would enable redevelopment of the East Side’s Frost Bank Center/Freeman Coliseum area into a year-round entertainment and event district.

Impact on business: Increased foot traffic, tourism, and demand for local vendors and services.

Proposition B

Would authorize county funding for a new downtown arena and sports district near Hemisfair.

Impact on business: Expands tourism, retail, hospitality, and entertainment opportunities while modernizing San Antonio’s downtown infrastructure.

Why Small Businesses Should Stay Engaged

- Every Vote Impacts the Bottom Line: Tax policy, infrastructure, and funding decisions directly shape operating costs and consumer behavior.

- Pro-Business Policies Drive Growth: Supporting these amendments helps maintain Texas’ status as a national leader in job creation and entrepreneurship.

- Your Awareness is Power: Understanding what’s on the ballot helps you plan, adapt, and stay ahead, protecting both your business and your community’s future.

*Marks SAHCC Legislative Priority

*Proposition 2: Ban on State Capital-Gains Tax

(SJR 18)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support]: Texas Protect individuals, families, estates, and trusts are not subject to a future state tax on investment gains.

Endorsed by: Texas Association of Business (TAB)

*Proposition 4: Dedicated Funding for Texas Water Fund (HJR 7)

- SAHCC Legislative Priority: Supports continuing the efforts of the 88th Legislature with respect to increased infrastructure funding, as well as facilitating the development of alternative supplies such as desalination, Aquifer Storage & Recovery, and recycled water.

- SAHCC Recommendation [Support] – Would set aside up to $1 billion each year from existing state sales-tax revenue for projects such as expanding water supplies, repairing aging systems, and improving flood protection.

Endorsed by: Texas 2036, Texas Association of Business

*Proposition 5: Property Tax Exemption for Retail Animal Feed (HJR 99)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] - Could lower costs for businesses that sell animal feed, and potentially for customers as well.

*Proposition 6: Ban on Securities or Occupation Taxes (HJR 4)

- SAHCC State Legislative Priority: Oppose any legislation that adds regulations that negatively impact private business’s daily operations and overall employment practices.

- SAHCC Recommendation [Support] Ensures the state does not impose new taxes on stock or other securities, trades, which could reassure investors and financial firms operating in Texas.

Endorsed by: Texas Association of Business (TAB)

*Proposition 7: Property Tax Exemption for Certain Surviving Military Spouses (HJR 133)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] - Provides homestead property-tax relief surviving spouses of veterans whose deaths are tied to a service-related disease.

Endorsed by: Texas Association of Business (TAB)

*Proposition 8: Ban on State Estate or Inheritance Taxes (HJR 2)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] – If passed, the Texas constitution permanently prohibits the legislature from creating a tax on an estate or inheritance after someone’s death.

Endorsed by: Texas Association of Business (TAB)

*Proposition 9: Business Personal Property Tax (HJR 1)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] - Enables House Bill 6, authorizing the Texas legislature to create a property-tax exemption for up to $125,000 of the value of business equipment, machinery, inventory, and other income-producing personal property. This would lower property taxes for many small and medium-sized businesses by reducing the taxable value of their operating assets.

Endorsed by: Texas Association of Business (TAB)

*Proposition 10: Temporary Property-Tax Exemption for Fire-damaged Homes (SJR 84)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] - Provides a temporary property tax exemption on the appraised value of a residence completely damaged by a fire. It provides financial relief while the home is being rebuilt so owners aren’t taxed on a house that no longer exists.

*Proposition 11: Increased School Homestead Exemption for Seniors and Individuals with a Disability (SJR 85)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] - Raises the school district Homestead Exemption for homeowners who are 65 or older or have a disability.

Endorsed by: Texas Association of Business (TAB)

*Proposition 13: Increase in homestead exemption from school district (SJR 2)

- SAHCC State Legislative Priority: Supports legislation that reduces the regulatory and property tax burden on all taxpayers.

- SAHCC Recommendation [Support] Raises the homestead exemption by $40,000. Up from the current $100,000 exemption.

*Proposition 14: Dementia Prevention & Research Institute (SJR 3)

Creates a Dementia Prevention and Research Institute of Texas and a dedicated fund with $3 billion from the state’s general revenue. The funding would support research, prevention, and treatment of dementia, Alzheimer's, Parkinson’s and related disorders.

Supporters Say:

- Creates a state institute and $3 billion fund to make Texas a leader in dementia, Alzheimer’s, and Parkinson’s research.

- Could attract top medical researchers, create high-quality jobs, and relieve long-term caregiving costs.

- Modeled on the successful Cancer Prevention & Research Institute of Texas (CPRIT), which has delivered strong economic and health returns.

- Texas’ budget surplus provides a unique opportunity to invest without new taxes.

Opponents Say:

- Establishes a new state bureaucracy and long-term taxpayer obligation outside the proper scope of government.

- Private industry, nonprofits, and universities can conduct this research without state involvement.